price to cash flow from assets formula

You divide the share price by the operating cash flow per share. This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio.

How To Compute The Present Value Of An Asset Simtrade Blogsimtrade Blog

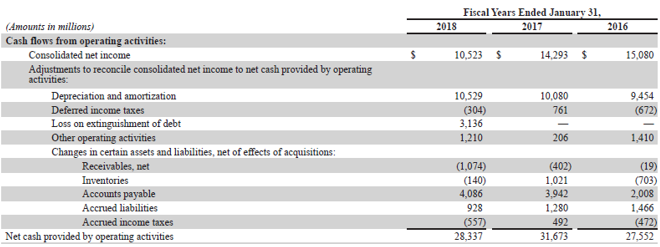

Operating cash flow is mentioned in the cash flow statement of the annual report.

. Your answer is 10 which means that investors pay 10 for every dollar of cash flow. The CF or cash flow found in the denominator of the ratio is obtained through a calculation of the trailing 12-month cash flows generated by. The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations.

Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018. N Net capitalspending. The company is generating cash flows of 3 per share so.

Price to Operating Cash Flow Current Market Price Operating Cash Flow. The market price per share is simply the stock price. Cash flow to total assets ratio measure the ability of the company to use its own assets to generate cash flow.

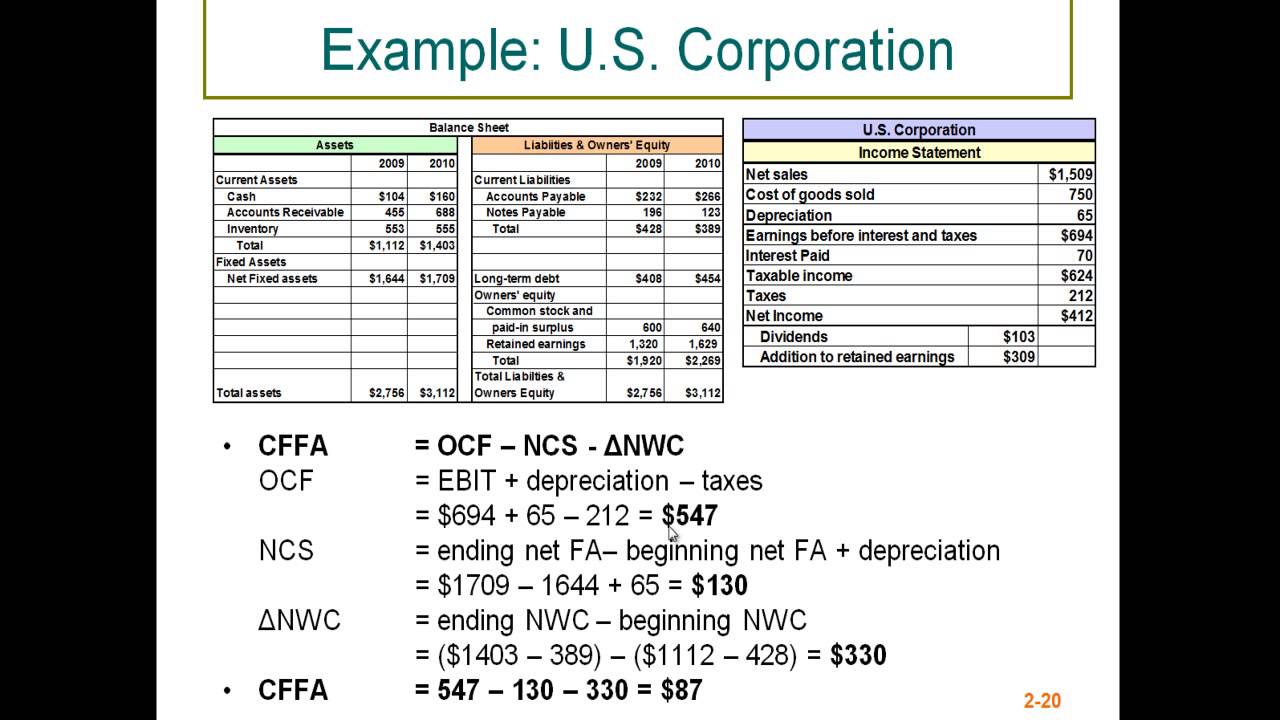

Price to cash flow from assets formula. Price-to-Cash Flow PCF Market Capitalization Cash Flow from Operations The formula for PCF is simply the market capitalization divided by the operating cash flows of the company. Johnson Paper Companys cash flow from assets for the previous year is 16000.

The numerator market capitalization is the total value for all stocks outstanding for a company. The price to cash flow ratio tells the investor the number of rupees that they are paying for every rupee in cash flow that the company earns. This is a positive cash flow.

Example of the Price to Cash Flow Ratio. This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio. Thus if the price to cash flow ratio is 3 then the investors are paying 3 rupees for a.

However to find out this ratio we need to calculate cash flow per share. W Changes in net working capital. Price to Free Cash Flow Current Market Price Free Cash Flow.

In case of Frost we need to estimate operating cash flows and then work out PCF as follows. This results in the following cash flow from assets calculation. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

Free cash flow sales revenue operating costs taxes required investments in operating capital where. The more cash flow company generate it means the more efficient company use asset. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow.

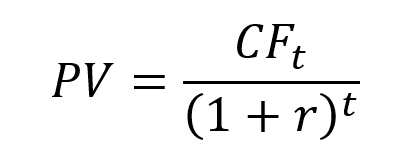

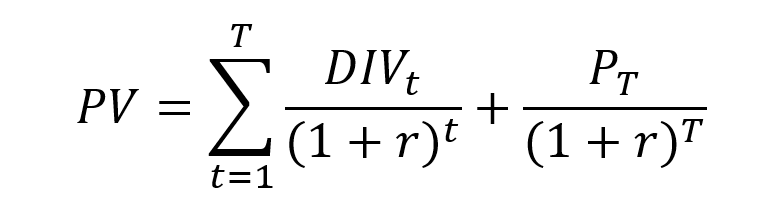

How to analyze the price-to-cash flow ratio. Cash Flow from Assets Calculator. The technique takes into account the time value of money or the fact that a dollar received today is worth more than a dollar received tomorrow.

Now you must find the price-to-cash flow ratio. Cash flow per share Cash Flows from Operating Activities Weighted-Average Number of Shares 30 million 2 million 15 per share. While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow.

The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share. 24000 -10000 2000 16000. The discounted cash flow technique is a financial tool used to determine the present value of future cash flows.

Price to Cash Flow Share Price or Market Cap Operating Cash Flow per share or Operating Cash Flow The PCF ratio equation can also be calculated using the market cap like this. The companys cash flow from assets may indicate to buyers that purchasing the company is a good value. It can help prevent the company from.

Price to Cash Flow Share Price Cash Flow per share. The common stock of a business is currently being sold on a stock exchange for 10 per share. Levered free cash flows only calculate post-debt cash flows or cash flows available for equity investors.

The Price - Cash Flow Ratio Formula The PCF ratio is the market price per share divided by the cash flow per share. Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow. Price to Cash flow Ratio Current Stock Price Cash Flow per Share 50 15 333.

Cash flow yield is generally expressed as a percentage and roughly allows you to compare cash flow if it were paid out 100 as dividends to other yields such as. The cash flow is the net between cash inflow and cash outflow from the company main business activities. Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital.

Free Cash Flow 93 million. The market capitalization is calculated by multiplying the latest closing share price by the total number of diluted shares outstanding. Free Cash Flow 227 million 32 million 65 million 101 million.

50 5 10. Terms in this set 8 Cash Flow From Assets Cash Flow to Creditors. The price-to-cash flow ratio can serve as an indicator of investment valuation.

In both of these examples investor expectations for future cash flows are driving the price of the stock rather than the amount of current cash flows. Operating cash flow formula. Thats because the FCF formula doesnt account for.

The inverse of the price to cash flow ratio is the cash flow yield. Market cap can typically be found with many stock quotes along with other common stock metrics. By discounting future cash flows at an appropriate rate the present value of those.

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Formula Example Calculate P Cf Ratio

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

How To Compute The Present Value Of An Asset Simtrade Blogsimtrade Blog

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

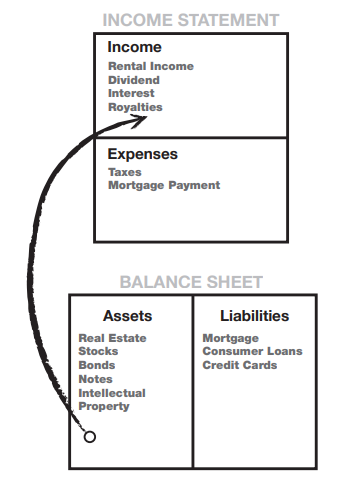

How To Identify A Cash Flow Pattern Of An Asset From Rich Dad Poor Dad

Price To Cash Flow Ratio P Cf Formula And Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow What Is It And What Is It For Efficy

Cash Flow Formula How To Calculate Cash Flow With Examples

Disposal Of Assets Disposal Of Assets Accountingcoach